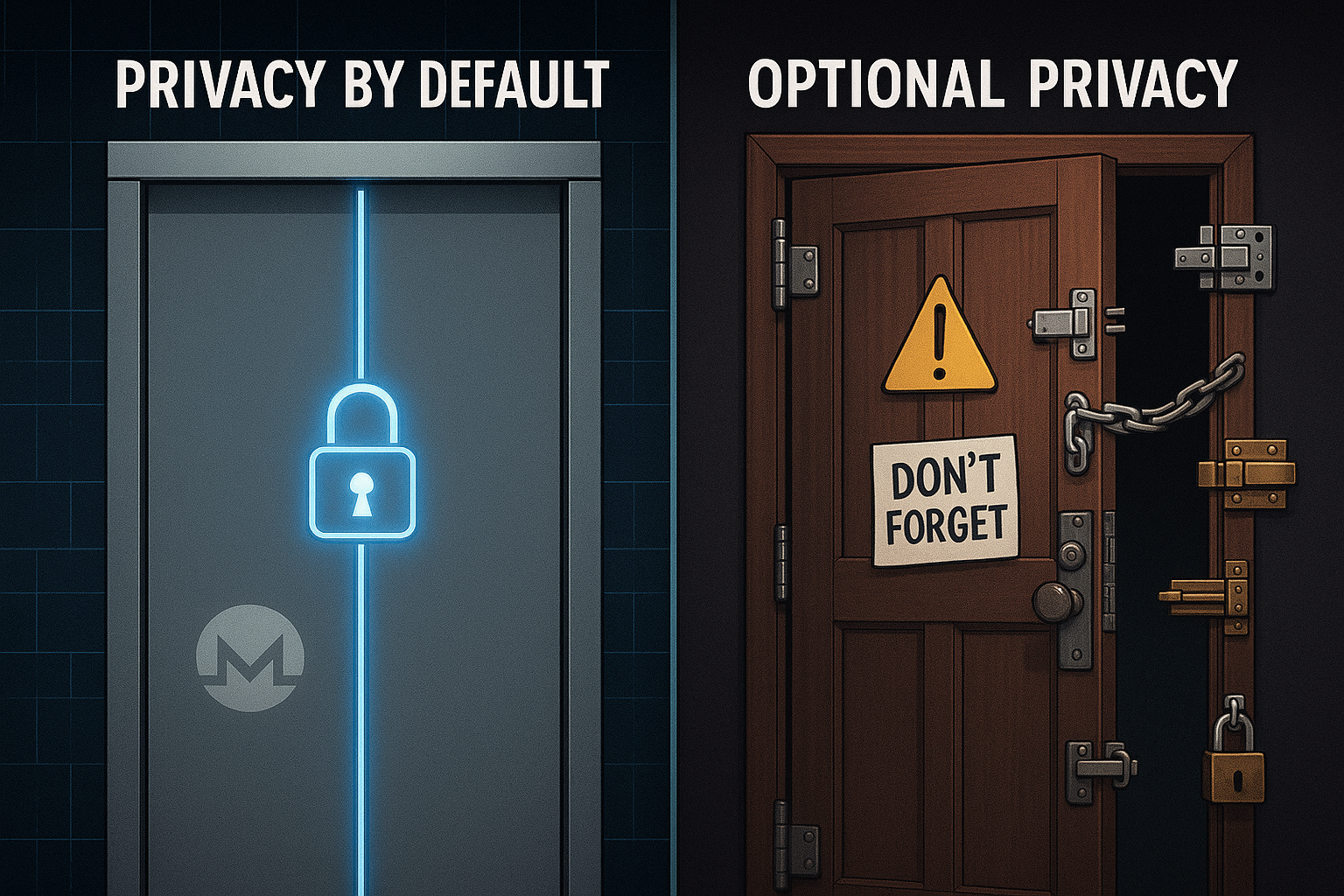

Let me tell you a story about privacy in cryptocurrency. It’s a tale of two philosophies, and spoiler alert: one of them is basically asking you to remember to lock your front door every single time you leave the house, while the other just builds houses with locks that work automatically. Guess which one actually keeps people safe?

I’ve spent way too much time diving into the privacy debate in crypto, and I’m here to make a case that might ruffle some feathers: privacy as an optional feature is like a parachute that only works if you remember to pull the ripcord. Sure, it’s technically there, but when 73% of people forget to use it (looking at you, Zcash users), maybe the problem isn’t the users, maybe it’s the design.

Let’s talk about why privacy-by-default cryptocurrencies like Monero, Salvium, Neptune Cash, and Abelian are fundamentally superior to their “privacy optional” cousins like Zcash, Litecoin MWEB, and Bitcoin with its growing collection of privacy band-aids (PayNym, Payjoin, Silent Payments, and even the Lightning Network, I’m losing count here).

Two Approaches to Privacy: The Automatic Door vs. The Door You Have to Remember to Close

Here’s the fundamental split in crypto privacy philosophy:

Privacy by Default: Every transaction is private. Period. You don’t have to do anything special, remember any settings, or read a 47-page manual on how to shield your transactions. It just works. Monero does this with Ring Signatures, Ring Confidential Transactions (RingCT), and Stealth Addresses. And they’re not resting on their laurels, Monero is developing Full-Chain Membership Proofs (FCMP++), which will crank the anonymity set from 16 decoys up to over 100 million outputs (basically the entire blockchain). That’s like hiding in a crowd that includes everyone who’s ever used Monero. Good luck finding Waldo in that scenario.

Transparency by Default (Optional Privacy): Your transactions are public by default, but hey, if you want privacy, just click this button, use this special address type, make sure your wallet supports it, hope the exchange you’re using does too, and don’t forget to enable it every single time. What could go wrong?

Spoiler: Everything. Everything could go wrong.

The Fungibility Problem: When Your Money Has a Criminal Record

Here’s a fun thought experiment: Imagine if someone offered to trade you a $20 bill that was once used in a bank robbery for your nice, clean $20 bill. Would you take it? Of course not! But wait—isn’t money supposed to be money? Isn’t that the whole point? Welcome to the fungibility problem in transparent cryptocurrencies.

This creates “tainted coins”, cryptocurrency with a sketchy past. Exchanges might refuse them. Merchants might reject them. They’re worth less than “clean” coins. Congratulations, you’ve just reinvented the problems of the traditional financial system, but with more steps! Now, here’s where optional privacy makes things even worse. When you create a system where some coins are transparent and some are shielded, you’re basically creating two classes of money:

1.Transparent coins: “Hi, I’m totally innocent! Look at my entire transaction history!”

2.Shielded coins: “I’m private, which definitely doesn’t make me look suspicious at all…”

It’s like wearing a disguise to the grocery store. Sure, you’re technically hidden, but everyone’s going to wonder what you’re hiding. Privacy by default solves this by making everyone wear the same “disguise”, which means it’s not a disguise at all, it’s just how things work. And Monero’s upcoming FCMP++ upgrade? It’s going to make that anonymity set so large that trying to trace a transaction will be like trying to find a specific grain of sand on a beach. While blindfolded. At night.

The Human Error

Let me hit you with some cold, hard facts: As of October 2025, only 20-27% of Zcash’s supply is in shielded pools. Read that again. Zcash has had privacy technology available since 2016. It’s the coin’s main selling point. And after nearly a decade, less than one in four users are actually using it. This isn’t because Zcash users are lazy or stupid. It’s because optional privacy doesn’t work at scale. People forget. Wallets don’t support it. Exchanges don’t enable it. The default is transparent, and humans are really, really good at just accepting defaults.

Meanwhile, blockchain analysis companies are having a field day. They use heuristics like the “common-input-ownership heuristic” (fancy words for “if multiple inputs are in one transaction, they probably belong to the same person”) to trace transactions. They look for patterns in change addresses, round numbers, wallet fingerprints, all the little breadcrumbs that transparent transactions leave behind. And when only 20% of transactions are shielded? Those shielded transactions stick out like a sore thumb. It’s like everyone walking around naked except for a few people wearing trench coats. Sure, the trench coat people are “covered,” but they’re also the most noticeable people in the room.

Bitcoin’s optional privacy features face the same uphill battle. PayNym is actually pretty clever, it lets you share a public payment code that generates unique addresses for each transaction, so you’re not reusing addresses. But it requires both sender and receiver to support it, wallet adoption is limited, and most Bitcoin users have never heard of it. Same story with Payjoin and Silent Payments. Great tech, terrible adoption. Unfortunately things don’t change with Litecoin’s MWEB.

Privacy by default sidesteps this entire problem. The anonymity set is everyone. You can’t forget to enable privacy because it’s not optional. It’s like the difference between remembering to lock your car and having a car that locks automatically when you walk away. One works, one depends on your memory.

The Lightning Network: When Layer 2 Still Can’t Escape Heuristics

Speaking of Bitcoin’s privacy attempts, let’s talk about the Lightning Network. It’s often touted as a privacy improvement because transactions happen off-chain. And to be fair, Lightning does offer better privacy than base-layer Bitcoin. But “better than terrible” isn’t exactly a ringing endorsement. Here’s the problem: Lightning suffers from its own set of privacy vulnerabilities that no amount of layer-2 magic can fully solve.

Cross-Layer Data Leakage: Lightning is built on Bitcoin’s transparent blockchain, creating what developers call “leaky abstractions.” When you open a channel, that funding transaction is on-chain. When you close it, that’s on-chain too. Force closes are especially revealing—they use specialized scripts unique to Lightning, so anyone can see that a particular transaction was a Lightning channel. If you used KYC’d Bitcoin to open that channel, congratulations, your Lightning node is now linked to your identity.

Payment Probing Attacks: Attackers can send fake payments with invalid hashes to probe channel balances. By doing this systematically across the network, they can create snapshots of liquidity distribution over time and literally watch payments flow through the network. It’s like having X-ray vision for Lightning channels.

“Man-in-the-Middle” Attacks: HTLCs (Hash Time-Locked Contracts) use the same payment hash across the entire route. If an attacker controls multiple nodes in your payment path, they can correlate the payment just by comparing hashes. Mobile wallets are especially vulnerable since they typically only have one connection to the network.

Timing Analysis: Even with onion routing, timing patterns leak information. Attackers controlling multiple nodes can use time differences in message propagation to trace payments through the network.

The fundamental issue? Lightning is built on a transparent foundation. You can add privacy features on top, but you can’t escape the fact that the base layer is public, and that leaks information upward. It’s like trying to build a private house on a glass floor, no matter how good your curtains are, people can still see your foundation.

CARROT and SPARC: The Next Evolution of Privacy-by-Default

While optional privacy systems are struggling to get users to adopt their features, privacy-by-default projects are pushing the boundaries of what’s possible. CARROT and SPARC, two protocols that show just how far ahead the privacy-by-default philosophy has evolved.

CARROT (Cryptonote Address on Rerandomizable-RingCT-Output Transactions) is an addressing protocol originally proposed for Monero and currently implemented by Salvium. It’s not just an incremental improvement, it’s a fundamental reimagining of how privacy coins work.

Here’s what makes CARROT special:

Full View-Only Wallets: Traditional privacy coins have a limitation: view-only wallets can only see incoming transactions, making balance displays inaccurate. CARROT solves this by enabling view-only wallets to monitor both incoming and outgoing transactions without compromising security. This might sound like a small thing, but it’s huge for usability and adoption.

Forward Secrecy: CARROT implements key rotation mechanisms that protect past transactions even if encryption is broken in the future. This is crucial for long-term privacy, especially with quantum computers looming on the horizon. Your transactions today will still be private in 2050, even if quantum computers can break today’s encryption.

Protection Against Known Attacks: CARROT fixes vulnerabilities like the Janus Attack (where attackers link multiple addresses to the same owner) and the Burning Bug (where users could lose funds from duplicate outputs). These are real attacks that have affected privacy coins, and CARROT eliminates them at the protocol level.

Rerandomizable Transactions: CARROT works with Full-Chain Membership Proofs to make all transaction outputs on the blockchain potential decoys. This dramatically enhances the anonymity set and makes chain analysis exponentially more difficult.

But wait, there’s more! Salvium is taking CARROT even further with SPARC (Spend Proof and Anonymized Returns for CARROT).

SPARC solves two problems that have plagued privacy coins:

1.Anonymized Returns: How do you send a refund to someone without knowing their address? SPARC enables encrypted return data in transactions that looks like random noise to everyone except the intended recipient. This is huge for e-commerce, escrow systems, and any scenario where you need two-way transactions.

2.Spend Authority Proofs: How do you prove you control an address without revealing your private keys? SPARC uses zero-knowledge proofs to let you demonstrate address ownership for regulatory compliance without compromising privacy.

This is the genius of the privacy-by-default approach: you start from a foundation of complete privacy, then add selective transparency tools for specific use cases. It’s the opposite of trying to bolt privacy onto a transparent system and hoping people remember to use it.

The Future is Post-Quantum (and Private)

Let’s zoom out and look at the horizon. While we’re all worried about today’s privacy, some projects are thinking about tomorrow’s threats. Quantum computers are coming. And when they arrive, they’re going to break a lot of the cryptography we currently rely on. It’s like knowing a hurricane is coming and deciding whether to build your house out of straw or brick.

Neptune Cash and Abelian are building with brick and they’re doing it in fascinatingly different ways.

Neptune Cash: The zk-STARK Revolution

Neptune Cash isn’t just another privacy coin, it’s a technical tour de force that represents the cutting edge of cryptographic innovation. It’s the first blockchain to integrate zk-STARKs directly at Layer-1, and if you understand what that means, you should be excited.

For those who don’t live and breathe cryptography, here’s the deal: most privacy coins using zero-knowledge proofs rely on zk-SNARKs. Traditional zk-SNARKs (like those originally used in Zcash’s Sprout and Sapling implementations) have a significant limitation, they require a “trusted setup” ceremony. This is basically a ritual where a group of people generate cryptographic parameters, and if even one of them is compromised or keeps their secret data, the entire system’s security is at risk. It’s like building a bank vault where the combination is split among several people, and you just have to trust that none of them wrote it down. (To Zcash’s credit, they upgraded to Halo 2 in May 2022, which eliminates the trusted setup requirement, but this shows the evolution needed to address the fundamental limitation of earlier zk-SNARK implementations.)

zk-STARKs, on the other hand, require no trusted setup from the start, no ceremonies, no parameter generation, no trust assumptions. They’re based on simpler cryptographic assumptions (collision-resistant hash functions instead of elliptic curves), making them more transparent and auditable. But here’s the real thing: zk-STARKs are quantum-resistant. When quantum computers arrive and start breaking elliptic curve cryptography, traditional zk-SNARKs will fall. zk-STARKs won’t. While Zcash’s newer Halo 2 also eliminates the trusted setup, Neptune Cash was built with zk-STARKs from day one, meaning quantum resistance and trustlessness were baked into the foundation rather than added later.

Neptune combines zk-STARKs with something called mutator sets, a novel cryptographic data structure that enables privacy without sacrificing blockchain succinctness. Traditional privacy coins ( like Monero) face a tradeoff: the bigger your anonymity set, the larger your blockchain grows. Mutator sets solve this by allowing transactions to remain private while keeping the blockchain size manageable. Neptune is the first blockchain protocol to implement this, and it’s a genuine breakthrough.

And because Neptune’s zk-STARK implementation happens at Layer-1 with client-side proving, every block contains just one big transaction and one proof. This isn’t just elegant, it’s a fundamentally different approach to blockchain privacy that scales without compromise. Plus, Neptune supports private smart contracts, meaning you can build programmable privacy applications on top of a foundation that’s already quantum-resistant.When people talk about “future-proofing,” this is what they mean. Neptune isn’t just private today, it’s designed to stay private when quantum computers are breaking everything else.

Abelian: The Multi-Tier Privacy Innovator

Abelian takes a different but equally fascinating approach to the quantum-resistant privacy problem. Instead of forcing everyone into a single privacy model, Abelian offers users two distinct wallet types, each optimized for different use cases.

Fully-Private Addresses work like you’d expect from a privacy-by-default coin: transactions are completely untraceable, wallet balances remain confidential, and you get maximum anonymity. Under the hood, Abelian uses lattice-based linkable ring signatures, lattice-based commitment schemes, and lattice-based zero-knowledge proofs, all following NIST post-quantum cryptography standards. It’s like Monero, but quantum-resistant from the ground up.

Pseudonymous Addresses, on the other hand, work more like Bitcoin: coin values are publicly visible, transactions are traceable on the blockchain, but you benefit from significantly lower gas fees and faster transaction speeds. Crucially, even these “transparent” addresses use lattice-based cryptography, so they’re still quantum-resistant. They’re enhanced with one-time coin addresses for receiver privacy, giving you more protection than raw Bitcoin while maintaining transparency when you need it.

Now, I know what you’re thinking: “Wait, isn’t this just optional privacy with extra steps?” And the answer is no and the distinction matters.

Abelian’s approach isn’t about forgetting to enable privacy or having transparency as the lazy default. It’s about consciously choosing the right tool for the right job. Need to make a private payment where anonymity is paramount? Use a Fully-Private Address. Need to make a payment where transparency is acceptable or even desirable (like a donation where you want public accountability), and you want to save on fees? Use a Pseudonymous Address. You can seamlessly transfer funds between wallet types, and both are recovered from the same 24-word mnemonic. The critical difference from optional privacy systems is that both address types are first-class citizens. There’s no stigma, no “tainted coins,” no assumption that pseudonymous addresses are for people who “have nothing to hide.” They’re simply different tools for different purposes, both quantum-resistant, both legitimate.

Abelian’s lattice-based cryptography also brings practical benefits: high-speed computation and lower energy consumption compared to other post-quantum methods. When quantum computers arrive, Abelian users won’t need to migrate to new addresses or upgrade their security model they’re already protected.

Monero’s FCMP++ upgrade also includes forward secrecy, meaning even if someone builds a quantum computer that can break discrete logarithms, they still can’t retroactively break the privacy of past transactions. And CARROT’s forward secrecy features provide additional protection against future cryptographic advances.

Meanwhile, optional privacy systems are still trying to get people to use their current privacy features. Good luck adding quantum resistance to that mix.

The Bottom Line: Privacy Isn’t a Feature, It’s a Foundation

Look, I get it. Optional privacy sounds great in theory. “Freedom of choice!” “User empowerment!” “Privacy when you want it!” But in practice, it’s a disaster. The numbers don’t lie:

•73-80% of Zcash users don’t use shielded transactions

•Fungibility is broken when some coins have histories and others don’t

•Human error is inevitable when privacy requires active effort

•Blockchain analysis companies have a field day with transparent transactions

•Even Lightning Network can’t escape heuristic failures and timing attacks

Privacy by default works because it doesn’t rely on users making perfect decisions every time. It doesn’t create two classes of coins. It doesn’t require you to read a manual or remember settings. It just works. In the end, the choice between privacy-by-default and transparency-by-default isn’t just technical, it’s philosophical. Do you believe privacy is a fundamental right that should be protected by default? Or do you believe it’s a feature that users should have to opt into (and most won’t)?

I know which side I’m on. And if you care about financial privacy, fungibility, and actually being able to use cryptocurrency as private digital cash, you should too.

Because privacy isn’t a feature you toggle on and off. It’s the foundation of financial freedom. And foundations need to be solid from the start, not optional add-ons you hope people remember to install.